Robert Schwartz Contributed to ALI CLE with a Summary of the new Federal Tax Provisions of the Build Back Better Program

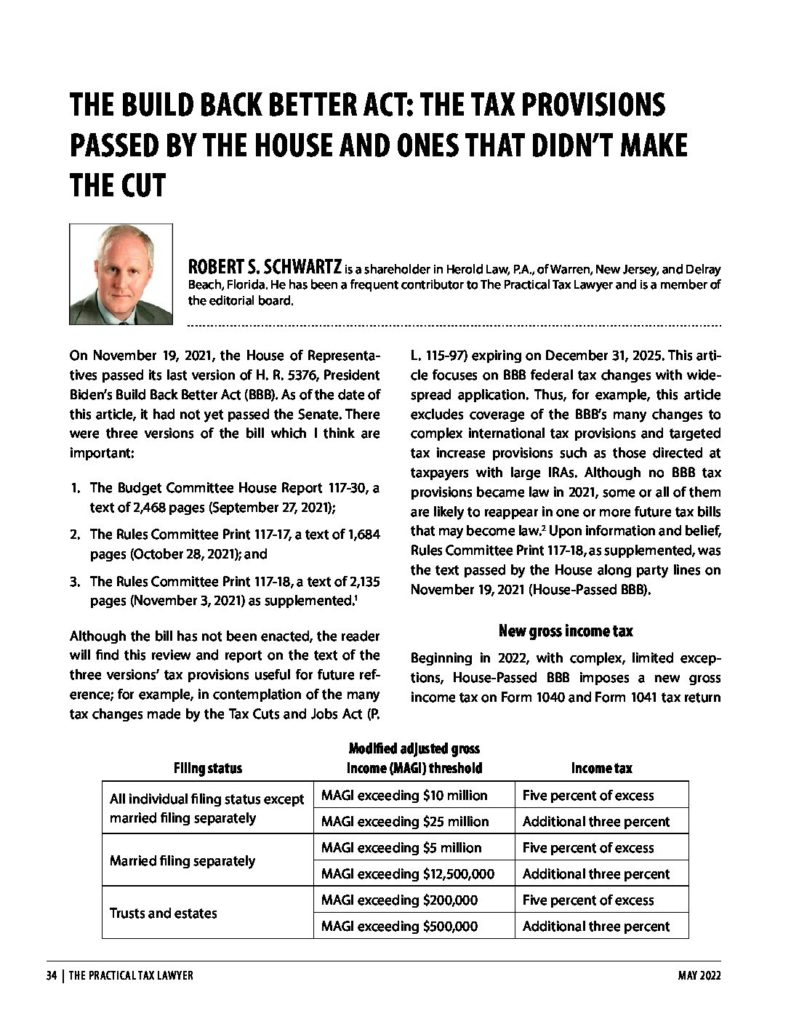

Robert Schwartz, who closely follows federal taxation developments, recently compiled and wrote a concise summary of the new federal taxation provisions of President Joe Biden’s Build Back Better (BBB) program. The BBB program was passed in the U.S. House of Representatives last November 19,2021 but was not actually scheduled for Senate action owing to the Senate majority lacking a consensus late last year. Robert also reviews a number of significant BBB taxation provisions that did not make it into the House passed Bill, but as with those that did, may become law in the not-too-distant future. Voter sentiment as now being polled and the poll that counts this coming November 8th will be most determinative of the final contours of any BBB tax legislation signed into law by Joe Biden and also of importance with what effective dates.

Read the full article here.

Reprinted by permission of ALI CLE, Philadelphia, PA. https://www.ali-cle.org/

908-679-5011

908-679-5011